News

Protect News

Our Bill Buster competition is on again. Enter for your chance to share the $20,000 prize pool! View updates on Instagram: @protectmembers

Demonstrating that none of us are bullet proof, ETU WA's Adam Woodage recently caused himself a bit of strife while working on his roof. He shares a glowing report of his experience utilising Protect income protection, which he labels his 'lifeline' during recovery from serious injury.

This year our dinner event in support of Mental Health Month raised funds for Youth Projects The Living Room

Supporting the Australian trades sector since 2000

Protect Industries

About Us

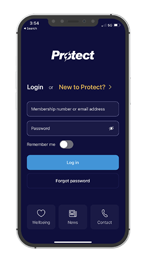

Preferred by 50,000 workers and 1,200 employers

We partner with employers and unions to bring workers the best employment benefits in the country.

Our primary purpose is to support our member employers, workers and their families during any period of unemployment, illness, injury, or personal difficulty.

AU & NZ Counselling Phone Numbers

1300 725 881 | 0800 300 143

Protect counselling is a free confidential service for individuals seeking support, as well as employers and workers wanting advice on the best method to assist colleagues dealing with a range of concerns:

COVID IMPACTS

SUICIDE PREVENTION

GAMBLING PROBLEMS

BULLYING & HARASSMENT

Depression & Anxiety

RELATIONSHIP ISSUES

SOCIAL ISOLATION

FINANCIAL PROBLEMS

SUBSTANCE ABUSE & ALCOHOL ADDICTION

STRESS & PRESSURE AT WORK