News

Protect News

You can now claim your full Protect severance balance whenever you need it.

We know that real support means being responsive to real life. That’s why, on 1 July 2025, we removed all severance account claim limits and waiting periods.

Mate, do we have some good news for you! To celebrate our 25th anniversary, we've doubled our Bill Buster Competition prize pool for this year, with over $40,000 to share with eight lucky Protect members.

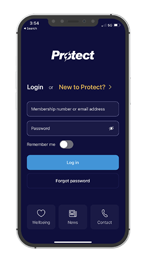

You'll notice a change when you log in to the App or portal. A new feature indicating which of two account types you hold. From now, we all have a Protect General Account.

Supporting the Australian trades sector since 2000

Protect Industries

About Us

Preferred by 60,000 workers and 1,200 employers

We partner with employers and unions to bring workers the best employment benefits in the country.

Our primary purpose is to support our member employers, workers and their families during any period of unemployment, illness, injury, or personal difficulty.

AU & NZ Counselling Phone Numbers

1300 725 881 | 0800 300 143

Protect counselling is a free confidential service for individuals seeking support, as well as employers and workers wanting advice on the best method to assist colleagues dealing with a range of concerns:

COVID IMPACTS

SUICIDE PREVENTION

GAMBLING PROBLEMS

BULLYING & HARASSMENT

Depression & Anxiety

RELATIONSHIP ISSUES

SOCIAL ISOLATION

FINANCIAL PROBLEMS

SUBSTANCE ABUSE & ALCOHOL ADDICTION

STRESS & PRESSURE AT WORK