Income protection insurance

Frequently asked questions

Income protection brochures are available by industry

Copies of Protect Injury and Sickness Wording and Product Disclosure Statements (PDS) can be requested from ATC Insurance Solutions.

Accidental dental injury that occurs outside of work

Members with Protect's income protection insurance cover, and their dependent family members, are covered for accidental dental injuries that occur outside of work however, cover is not provided for normal maintenance of dental health. Up to four claims per family are permitted each year.

Claim forms are available at our Claim page.

What happens if I suffer a dental injury at work?

Workers compensation provides protection for work-related injuries.

For more comprehensive information on your dental cover please download your industry income protection brochure, available above or from your industry page, or speak to one of our Field Officers.

Your policy brochure provides that information

Your Protect income protection insurance policy may provide lump sum death benefits, serious trauma and accidental dental injury payments. It may also provide a payment for a fractured or broken bone e.g. spine, neck, hip, leg, jaw, rib, arm or nose.

Please review your relevant industry policy brochure below for details on the benefit payable for broken bones and visit our claim page for a Broken Bones Claim Form, should you require one. If you would like assistance completing a claim form please contact a Protect Field Officer.

Copies of Protect Injury and Sickness Wording and Product Disclosure Statements (PDS) can be requested from ATC Insurance Solutions.

Additional benefits

Protect Extra Cover provides additional insurance benefits exclusive to financial members of the union policy holder.

These benefits may include:

- extended cover

- increased funeral expenses

- emergency home help

- domestic assistance

- chauffeur plan

Union members should check their policy brochure to see if any of these benefits apply.

Copies of Protect Injury and Sickness Wording and Product Disclosure Statements (PDS) can be requested from ATC Insurance Solutions.

Check your policy

![]() Download

Download

Electrical, Rail & Lift

Standard Injury & Sickness Cover

Fire Rescue

Metals

Maritime

Maritime Injury & Illness Cover

MUNZ Maritime Injury & Illness Cover

Civil Construction

From the insurer

Copies of Protect Injury and Sickness Wording and Product Disclosure Statements (PDS) can be requested from ATC Insurance Solutions.

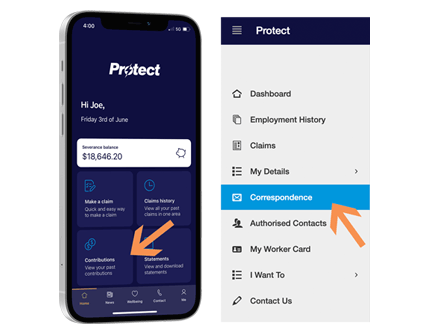

View contributions via the App or your online account

Contributions can be tracked via the 'contributions' tab on the Protect App (screen pictured left) or by viewing 'correspondence' on the workers portal (screen pictured right).

Answers to FAQs regarding online account and App access can be found here.

Download IP claim forms here

Australian Claim Forms

Australian Claim Forms

- Injury and Sickness Claim Form

- Accidental Dental Injury Claim Form

- Broken Bone Claim Form

- Accidental Death Claim Form

- Funeral Benefit Claim Form

![]() New Zealand Claim Forms

New Zealand Claim Forms

For further claim information visit our Claim page

Protect administers insurance products for ATC Insurance Solutions. Once your claim form is complete keep a copy and deliver the original to:

ATC Insurance Solutions

Level 4, 451 Little Bourke Street

Melbourne VIC 3000

Phone: 03 9258 1770

Freecall: 1800 994 694

Email: info@atcis.com.au

Download a claim form

Protect administers insurance products for ATC Insurance Solutions. You can go directly to the ATC site for comprehensive information about claiming, or simply access the relevant claim form here:

![]() Australian Claim Forms

Australian Claim Forms

- Injury and Sickness Claim Form

- Accidental Dental Injury Claim Form

- Broken Bone Claim Form

- Accidental Death Claim Form

- Funeral Benefit Claim Form

![]() New Zealand Claim Forms

New Zealand Claim Forms

For further claiming information vist the Claim page.

Lodge your claim form

Once completed, keep a copy and deliver the original to:

ATC Insurance Solutions

Level 4, 451 Little Bourke Street

Melbourne VIC 3000

Phone: 03 9258 1770

Freecall: 1800 994 694

Email: info@atcis.com.au

Here to help

Sections of your claim form will need to be completed by you and others by your employer or medical practitioner. If you strike a hurdle, don't be shy in giving us a call. The Protect Field Team are independent of the insurer and work with members to ensure claims progress as smoothly as possible. Officers can visit you at home, at work, or at the hospital if need be, to assist you with your claim.

(Pictured L-R) Field Officers: Steve, Brett, Joyce, Gary, Craig, John & Glenn can be contacted via our Member Services Team on 1300 344 249. You can also leave a message for any one of them through their direct contacts linked below.

The Protect Field Team

The Protect Field Team are independent of the insurer and work with members to ensure claims progress as smoothly as possible. (Pictured L-R) Field Officers: Glenn, Gary, Steve, Brett, Joyce, Craig & John can be contacted via our Member Services Team on 1300 344 249. You can also leave a message for any one of them through their direct contacts linked below.

It depends on your cover

Please note that you do not have to exhaust your sick leave, or any other leave entitlement before you can claim on your income protection insurance. However, a waiting period applies to each claim, generally commencing from the first day of medically certified disablement. Waiting periods are typically 14 or 30 days. Please check your policy brochure to determine the period applicable to you.

For assistance lodging a claim please contact a Protect Field Officer.

Check your policy

![]() Download

Download

Electrical

Fire Rescue

Metals

Firefighter IP is reimbursed and not tax deductible

New Zealand and Victorian firefighters with Protect income protection insurance have their premiums paid through an allowance and are therefore not tax deductible.

For further information regarding firefighter policies, please contact a Protect Field Officer.

Members that contribute to insurance premiums should speak to an accountant or financial advisor regarding claiming payments, as we are not permitted to provide financial advice.

Firefighters should note, that as their income protection allowance is reimbursed it is not tax deductible.