Severance & redundancy

Frequently asked questions

Right here

Our severance and redundancy brochure is updated regularly to promote the latest regarding your Protect account. This version includes updated tax free limits and detailed advice about claiming and accessing your account online.

If you would like hard copies sent to your workplace please contact our Member Services Team via email or phone 1300 344 249.

Yes, there are two account types

Protect offers two severance account types to ensure a distinction between redundancy payments and voluntary termination payments for the ATO.

You can only hold one type of account at a time. All new members start with the default GEN account.

The reason you leave employment decides which account type you claim from.

1. GENERAL ACCOUNT (GEN)

Pays claims due to involuntary end of employment.

- Tax free Genuine Redundancy

- Non Voluntary Termination

(such as dismissal or end of contract)

NOTE: Both accounts make payment for total and permanent disability and death (via beneficiaries).

2. VOLUNTARY TERMINATION ACCOUNT (VTA)

If you choose to leave you job you must permanently change to a Voluntary Termination Account as part of the claim process.

Pays claims due to voluntary end of employment.

- Resignation

- Retirement

- Promotion off the tools

When you separate from your employer

If you lose your job or stop work for any reason, you or your beneficiaries can make a claim from your Protect account. These reasons may include:

INVOLUNTARY REASONS

- Redundancy*

- Termination

VOLUNTARY REASONS

- Resignation

- Retirement

- Promotion to an above award position, or 'off the tools'

OTHER ELIGIBLE CIRCUMSTANCES

- Total & permanent disability

- Death (via beneficiaries)

If your employment ceases, claims can be made any time from the Protect App or your online Protect account - distinguished by the yellow worker log in button on each page of our website.

* Only a payment for a genuine redundancy is eligible for the tax-free limit, all other termination event payments are taxed according to ATO rules.

The reason for leaving employment otherwise known as the 'termination event', dictates the tax applied.

*The tax free threshold for the 2025/2026 financial year is $13,100 for the initial year, and $6,552 for each full year of service with your employer.

Use the App

All severance claims can be made via:

- The Protect App or

- Your online Protect account

Claims made via these online options can be made at any time of day and are the quickest and simplest avenues for accessing your entitlements.

Need help?

Our Member Services Team can help step you through the process phone 1300 344 249 or email info@protect.net.au

You will need to complete a claim form

- Your employer confirms your redundancy

Your employer is required to confirm your redundancy details via their online Protect account - however, you may proceed with your claim as soon as you have separated from your employment. - You complete a claim form

To lodge a redundancy claim, you must complete a Protect claim form. For fastest results you should do that electronically via the App or by logging in to your online account, accessible via the workers portal (yellow button) on the top right of every page of this website. - If details are missing, we follow up with your employer

If your employer hasn’t provided us with a termination date you can upload a separation certificate as confirmation of termination or Protect will contact your employer to confirm your termination. - You are paid into your nominated bank account

When your redundancy status is confirmed by the employer and your claim has been accepted, you will be entitled to your funds tax free, up to the tax free threshold. Please allow 1-3 business days for the funds to appear in your nominated bank account.

No limits, no waiting

You can now claim your full Protect severance balance - whenever you need it.

We believe that real support means being responsive to real life. That’s why, from 1 July 2025, we removed all severance account claim limits and waiting periods.

Whether you’re between jobs, retiring, or simply moving forward, you now have full access to your Protect severance balance immediately after leaving employment, no more staged claims and no delays.

![]() Download:

Download:

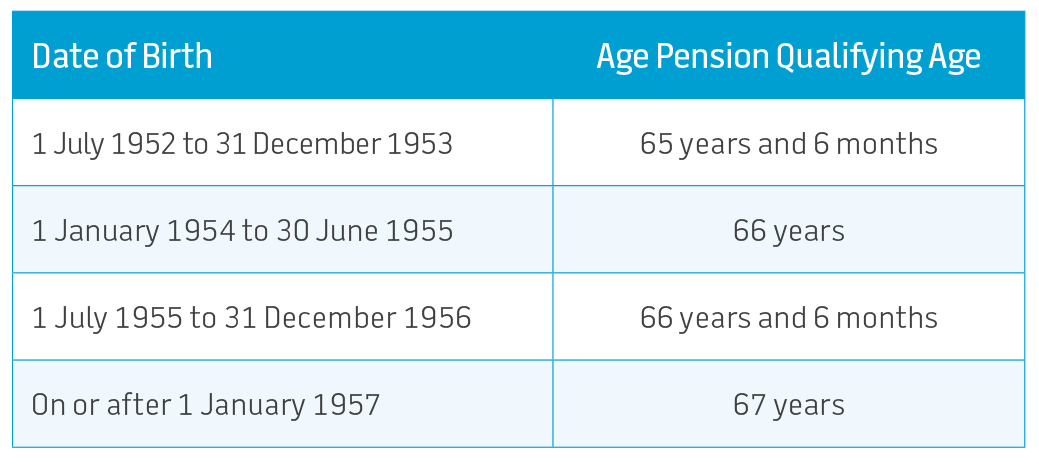

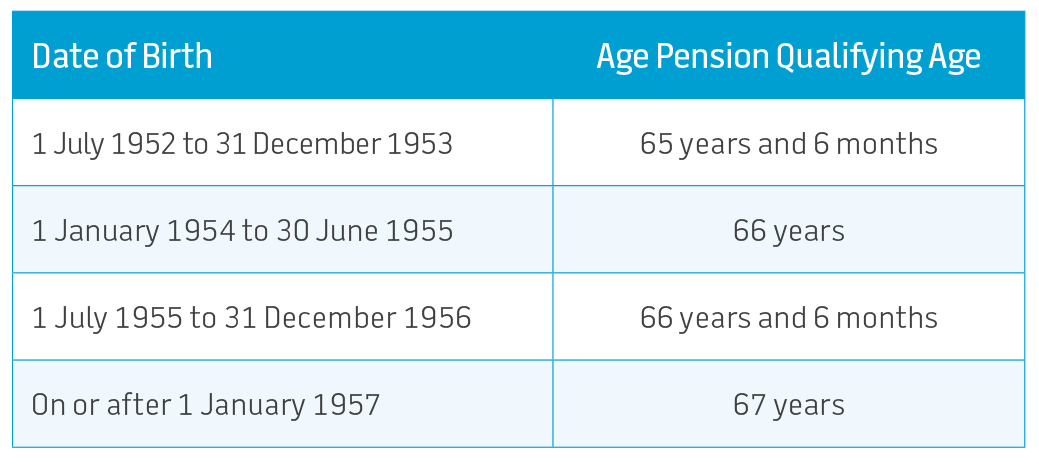

Tax free redundancy payments are aligned with the age pension qualifying age

You are eligible to receive tax free redundancy claims up to your age pension age.

Claims on a Protect account due to genuine redundancy attracts a tax free component, based on your length of service with youremployer. Previously you could only benefit from this if you were under the age of 65. However, legislation has extended the age limit to match an individual’s age pension qualifying age, which means those working longer in life are no longer exempt from the tax benefits of being made redundant.

However , if you are pension age or older on the day of your dismissal, the ATO will consider the event a 'non-genuine redundancy' and you will not qualify for a tax free component.

Within 5 days

Payment will be made to your account within five business days of receiving your initial severance claim, provided your claim is accepted.

The Member Services Team

Our Member Services Team is available to answer all queries relating to your Protect account. Calling 1300 344 249 will also grant you access to our Field Officers who are able to visit you in person should you require that level of assistance.

Email: info@protect.net.au

Simply complete a transfer form

If you wish to roll an existing severance account into Protect, you need to complete a transfer form. Transfer forms are typically just one page authorisating that your balance be transferred to your Protect account. Give us a call and we can supply you with the form relevant to your exisiting fund.

Contact us

Our Member Services Team is available to answer all queries relating to your Protect account. Calling 1300 344 249 will also grant you access to our Field Officers who are able to visit you in person should you require that level of assistance.

Email: info@protect.net.au

Tax is determined by your termination event

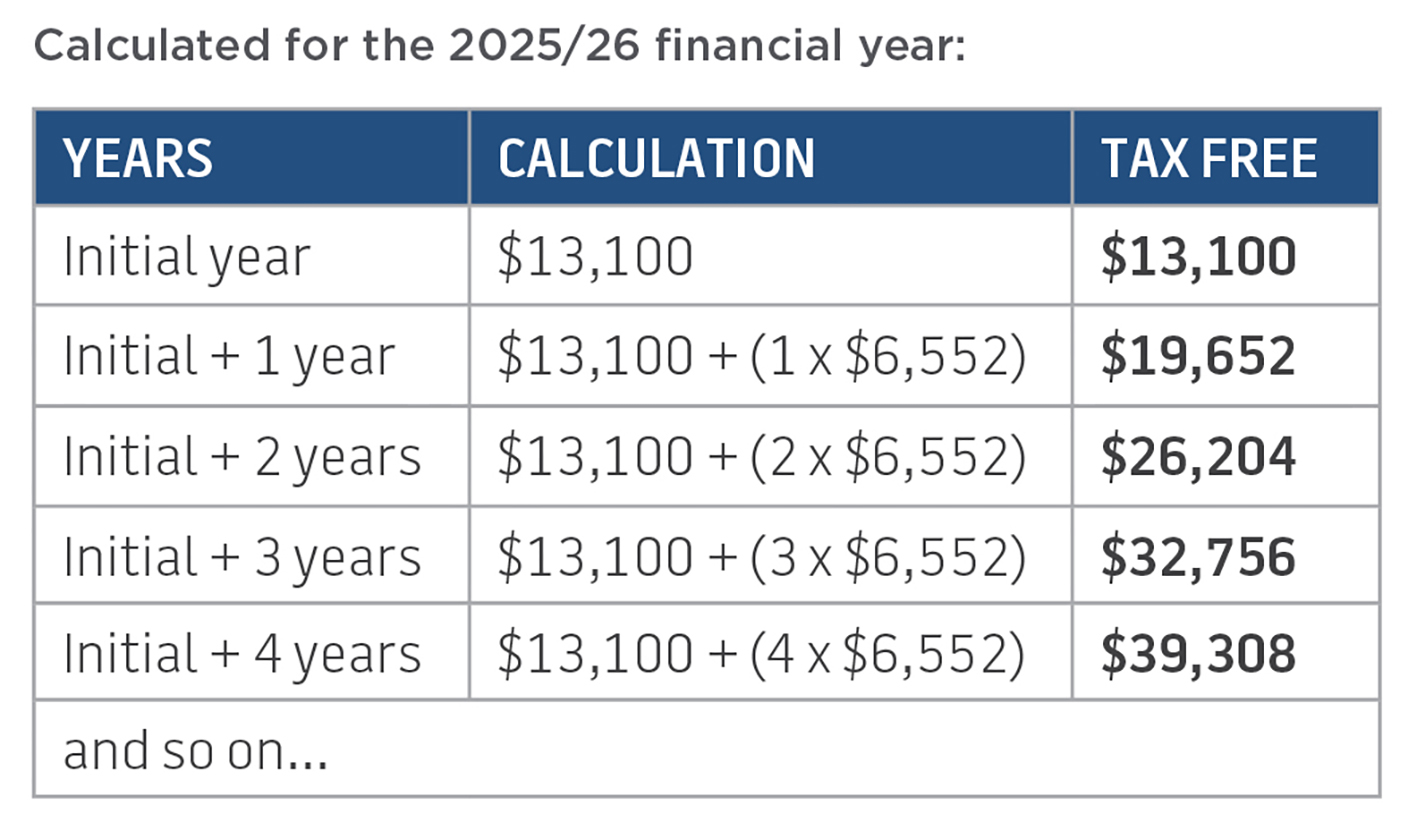

*The tax free threshold for the 2025/2026 financial year is $13,100 for the initial year, and $6,552 for each full year of service with your employer.

Any portion of a genuine redundancy claim that exceeds the tax free threshold is taxed at 32% if you're below preservation age, and 17% if above.

Other payments and Government Benefits

Your Protect severance payment may affect other Commonwealth Government benefits, such as the family tax benefit, childcare benefit and private health insurance rebate. You should consult your financial advisor, the Australian Tax Office or Centrelink for advice on how your personal circumstances may be affected.

Additional tax information

Late termination payments

We are legally required to withhold 47% tax from all severance claims made beyond 12 months of your retirement/termination date.

This law does not apply to redundancy claims.

Eligible Termination Payment Cap

Concessional tax rates of 32% (or 17% if you have reached your preservation age) only apply to the first $260,000 of all Eligible Termination Payments (ETP). Beyond this cap we are required to withhold 47% tax.

Deceased Claim Tax Rates

If you die, payments from your Protect severance account are generally not taxed if the beneficiaries are your financial dependents or your estate.

If your beneficiaries are not your financial dependents, 32% tax will generally apply to the payment from your account.

Whole-of-Income Cap

Any payment received not resulting from redundancy may also be subject to higher taxation via your personal tax return, if your taxable income plus this payment exceeds $180,000.

Please consult your financial advisor if you believe this may apply to you.

The tax free limit on redundancy payments

A genuine redundancy payment is tax-free up to a certain limit, based on the number of whole years of service you've completed with your employer.

For the 2025/26 financial year, the limit is:

$13,100 plus $6,552 for each complete year of service

Example of savings:

- Jim has a balance of $10,000 in his Protect account

- He is under 67 years

- He has been with his current contributing employer for two and a half years

When Jim is made redundant he lodges a claim with Protect. Jim is entitled to a tax-free redundancy payment of up to $26,204. Calculated as: ($13,100 + [2 x $6,552])

Therefore the entire balance of Jim’s account will be paid out to him tax-free.

Claims are available on your MyGov account

Protect has been utilising Single Tough Payroll (STP) since 2021 to advise the ATO of termination claims paid to you.

Your claims will be available on your MyGov account within 48 hours of payment. You will no longer receive PAYG Summaries from us. If you received two or more termination payments during a financial year, they will be consolidated on your MyGov account.

Please note that we are not required to advise the ATO of tax-free genuine redundancy claims (Lump Sum D). Detail of these payments can be found via your online Protect account. Log in to the worker's portal using the yellow button available at the top right of every page of this website, or use the Protect App.

No

All retirement claims are subject to tax as determined by the Australian Taxation Office. The only 'termination event' (reason for employment ending), that attracts a tax free component is genuine redundancy and the ATO does not permit genuine redundancy claims by those who have reached their pension age, or older, on the day of dismissal.

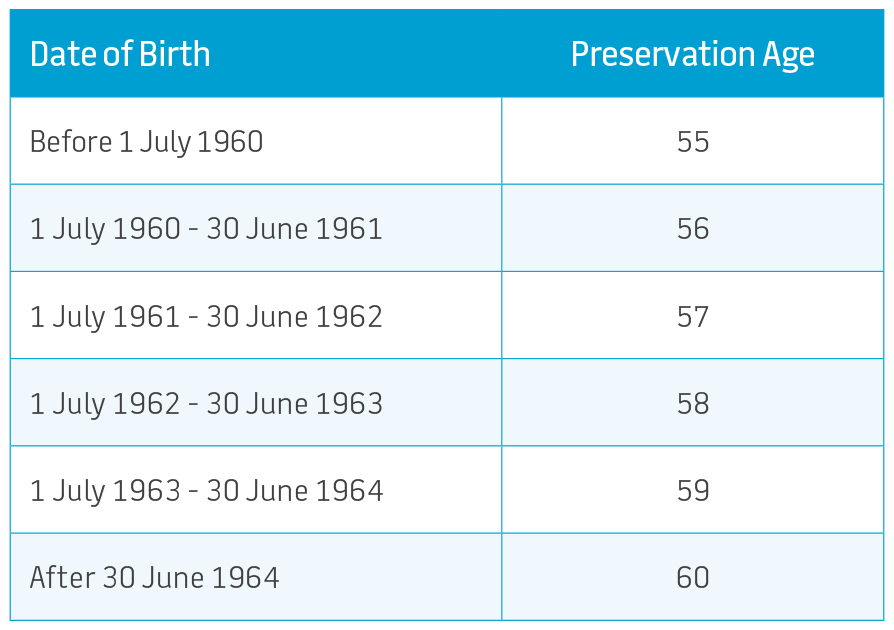

It depends on your date of birth

Your preservation age is generally the age that you can retire and access your superannuation or other retirement-related benefits. Your preservation age depends on your date of birth and affects the rate of tax you will pay on a severance claim.

Protect members who have retired and are over their preservation age may claim their entire severance balance.

It depends on your date of birth

The age pension qualifying age increased to 67 years on 1 July 2023. The pension age is relevant to some Protect members as ATO rules only allow you to claim genuine redundancy up to your pension age.